Find Great Tips &

Strategies Here that the

Banks Won’t Tell You

Deal with Credit Card Interest

Let's face it; Canadians carry huge balances on their cards, and at an average of 19.9% interest*, banks are raking in huge profits. Credit cards can work to your advantage if you use them properly!

Paying too much interest on your credit card is a common trap many Canadians fall into. In fact, the credit card companies keep the minimum payment low (around 3%) so you won't notice the 19.9% average interest they charge on outstanding balances.

Here's a typical payment scenario

Let's say you run up a holiday debt of $8,000.

Your January bill will show a minimum payment of $240. If you stick to this monthly amount at 19.9% interest, it will take you over four years to pay off the debt.

During that period, you will pay $3,760 in interest charges, bringing your total to $11,760!

Here are a few simple tips to ensure that you don't pay more interest than you need to.

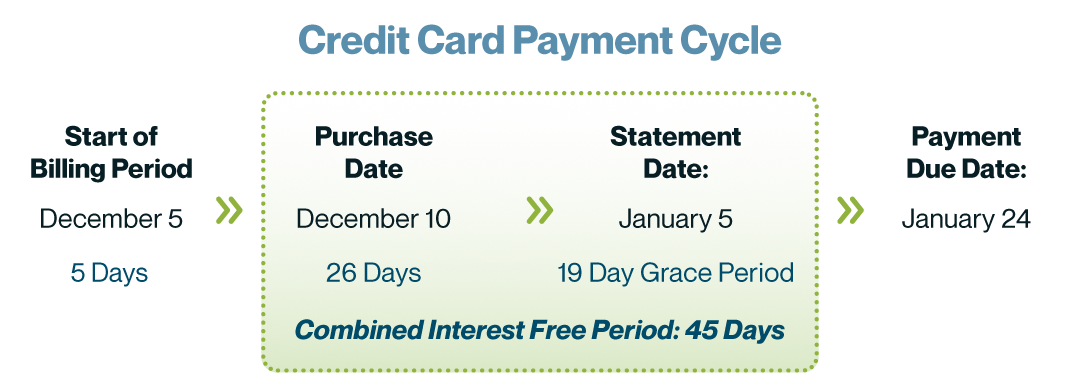

One of the keys to dealing with credit card interest is understanding your credit card payment cycle. When you pay on time, you avoid late fees and interest, save money, and steadily build your credit score.

Here are a few tips to better understand your credit cards payment cycle:

- Your credit card may allow up to 50 days interest-free credit on your purchases if you pay off the full (not minimum) balance every month.

- Buy early in the payment cycle, and you'll get the maximum interest free period. Your minimum is the grace period - 21 days is the legal minimum in Canada.

To take advantage of the payment cycle, first it's important to know what your cards interest free periods are. Typical interest free periods for Canadian credit cards include:

- The time between the purchase and the end of the billing period.

- A grace period between the statement date and the payment due date.

* Credit Card interest rates will vary. Please review your credit card’s interest rates, interest-free grace periods and payment cycle details carefully before making decisions.

You should extract all the benefits you can from your credit card. This includes cashback, travel incentives or other points and rewards.

Wealthy Canadians typically select one credit card to be their “work horse” and then use a separate back up card for emergencies. By using just one credit card, your travel points or other perks will be significant enough to make good use of and you'll also avoid the impossible task of trying to keep track of six or more payment cycles.

Once you’ve selected your work horse, cancel all the other credit cards you don't use. These can include department stores cards and gas cards that typically charge higher interest rates.

When selecting your “Work Horse” you should consider the following criteria:

1. Acceptability: If you're going to run all your expenses through one card, it needs to be accepted everywhere you go. VISA or MasterCard do the trick.

2. Credit limit: This has to be practical, especially since you'll be putting larger numbers through than you would if it were one of many cards.

3. Payment cycle: Look at the fine print regarding due dates, penalties, etc.

4. Perks: Cards offer perks like cash back, travel points, and Canadian Tire Money. Are they worth it? Yes, but only if you take advantage of them. If you have family overseas and you visit them regularly, your travel points will reduce your expenses, and help with the rental cars as well.

5. Annual Fee: Some cards, such as Gold and Platinum cards, charge an annual fee. Make sure you factor this in.

6. Online banking: If your credit card account can be accessed and paid off online, it will make it much easier to master the payment cycle.

7. Interest Rate: Low interest cards have rates as low as 10%, which will help if you need an extra month to pay off a large expenditure. But for handling longer-term debt, you can do significantly better with other types of loans. (Note: Some cards offer introductory rates as low as 0% for transferred balance. However, the rates expire after a few months, so you need to read the fine print to determine how good the card will be in the long term.)

Consider this scenario, let’s say a major gold card charges $120 per year annual fee and pays one travel point for every dollar you spend, plus free rental car insurance.

If you charge $20,000 on your card in a year, you will receive 20,000 travel points.

Let’s also assume these redeem for $300 off your holiday air ticket. If you rent a car for 2 weeks, you'll save about $6 per day in collision insurance, another $84.

After your annual fee, this leaves you with a profit of $264! And that doesn't include the interest you may have earned while taking advantage of the interest-free periods on the card.

Your goals are closer than they appear and a home equity loan can get you to the finish line.

We’re putting our money where our mouth is. Get the lowest rate on your home equity Loan from Capital Direct®, or we’ll give you $500.