Consolidate Your Debt

Debt consolidation is when you transfer all of your debt into a single loan. The key to getting rid of debt is to commit to fixed, not declining, monthly payments.

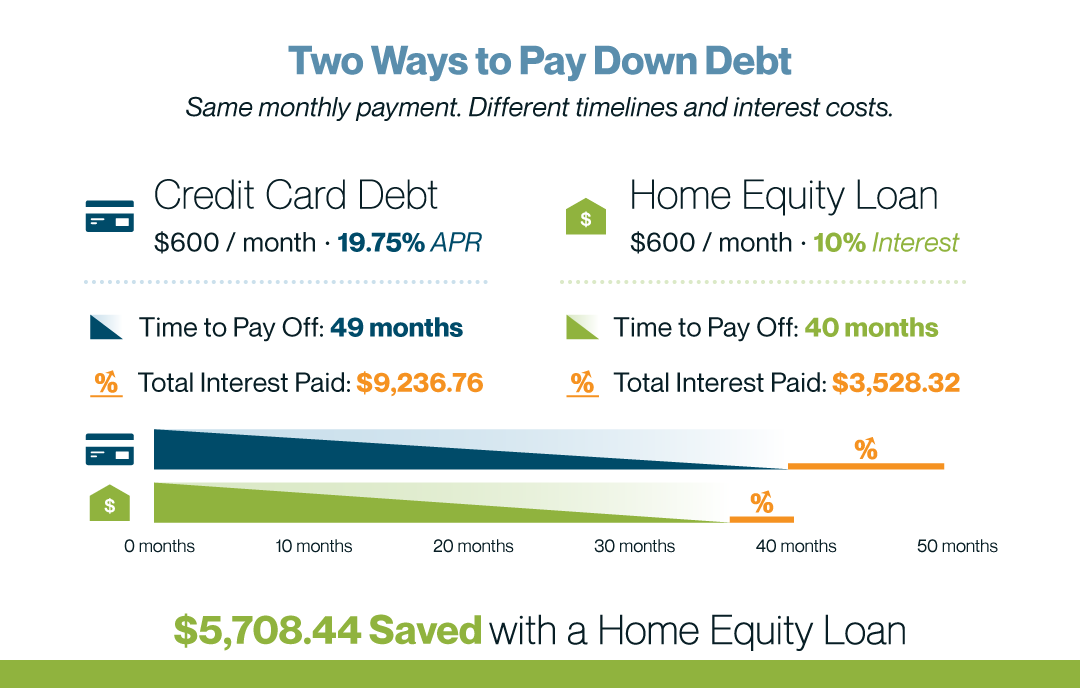

Let’s say, with your 19.75% credit card Annual Percentage Rates (APR), if you were to pay off the debt at a fixed rate of $600 per month, the amount of your first payment, you would pay the debt off in only 49 months, or a little over 4 years, and pay $9236.76 in interest. This is clearly a lot better. But you can do much better still with a home equity loan.

Suppose you take out a home equity loan at 10% interest. If you pay it off at $600 per month, you will retire the debt in 40 months - nine months sooner than with the credit card. But best of all, your interest cost will be reduced from $9236.76 to $3528.32. That's $5,708.44 in your pocket or almost a two-thirds reduction in interest costs with exactly the same monthly payments!