What is Home Equity?

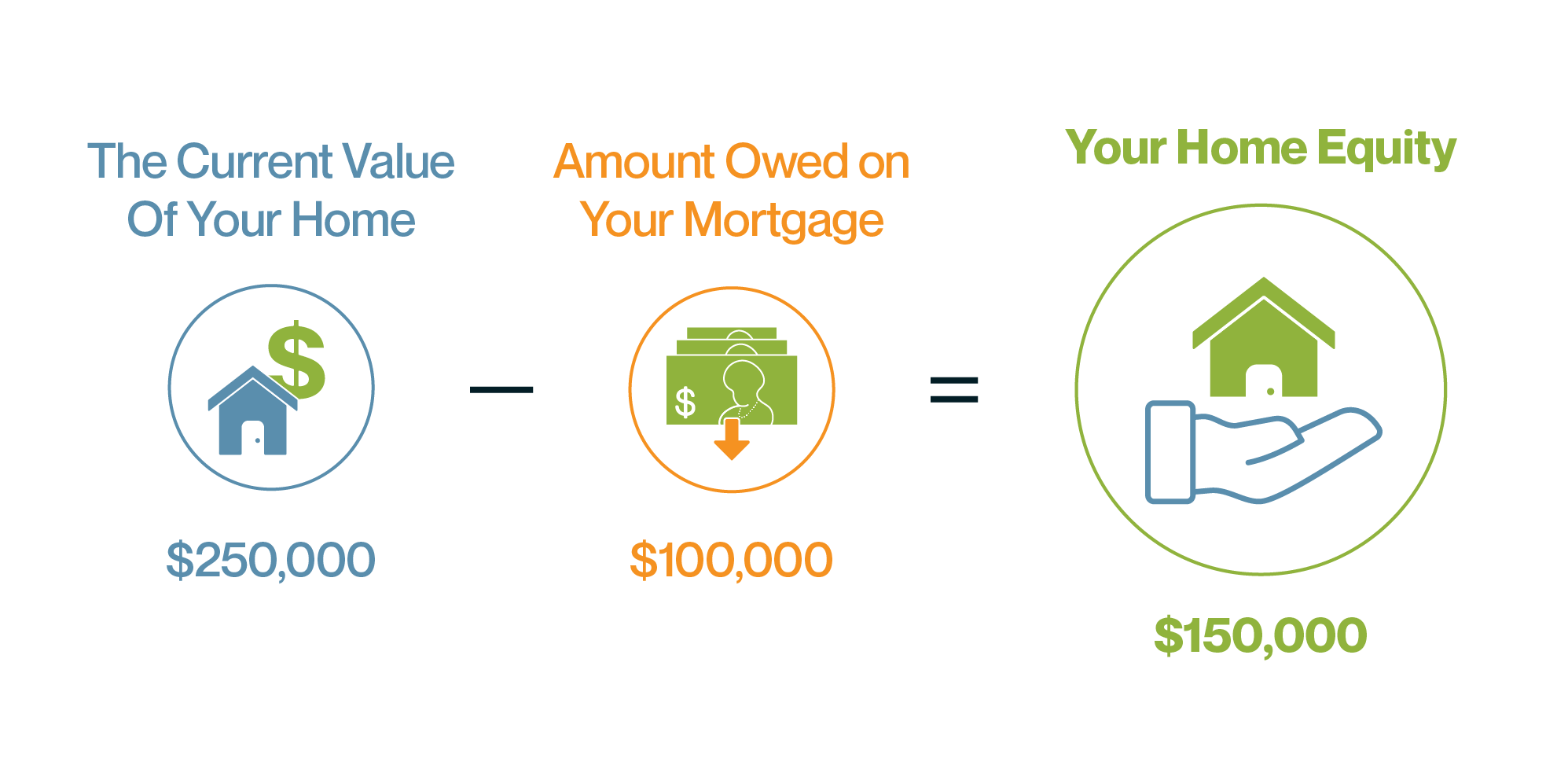

Home equity is the value of your home minus the amount you owe on your mortgage. Your power to raise money is based in part on the assets you currently own. If you are like most Canadians, your largest asset is your home.

Home equity represents the money that you have invested in your home, and consequently, the portion of your home that is yours - free and clear.

Suppose you own a home that is valued at $250,000. If you owe $100,000 on your mortgage, your equity can be calculated as:

Keep an Eye on the Housing Market

Because equity is tied to current value, it is subject to market demand for homes similar to yours. The amount of equity you have in your home, therefore, can rise and fall according to conditions in the housing market. Staying informed about your local real estate market is important if you are to take full advantage of your home as an asset.

Rising Real Estate Prices

Home equity is based on the current value. Notice that we said "current value of your home." If real estate prices have gone up in your area, and the value of your home has increased, your equity will have increased as well. Therefore, if the $250,000 home described above increases in value by $50,000, your equity in the home will also increase by $50,000!