provided to date: $ 1,461,345,453

Capital Direct Articles of Interest

Multiple articles have underscored the advantages of incorporating private equity, real estate assets, and commercial mortgage loans into investment strategies, showcasing the tangible benefits these choices can bring to our clientele.

Articles Archive

Canada's annual inflation unchanged at 1.7% in May, core measures slightly ease

Mark Carney's Housing Plan: Timeline and Implementation

Emerging Trends in Canadian Real Estate 2025

How to add 60 per cent to your home’s value - without adding rooms

Baby boomers and gen X are taking on more mortgage debt

Sick of home-owner stress, retirees can invest windfall from sale

FP Answers: What investments other than GICs protect buying power?

From small to extraordinary: The effect of compounding in investing

What to do if your mortgage application is denied

12/19/2023 Fundamental Review - December 19, 2023

Capital Direct's Impactful Partnership with Cause We Care: A Season of Giving - December 8, 2023

11/23/2023 Fundamental Review - November 23, 2023

11/19/2023 Fundamental Review - November 19, 2023

Cause We Care Holiday Care Package Campaign - November 15, 2023

10/30/2023 Fundamental Review - October 30th, 2023

JPMorgan Advocates for a 60/40 Portfolio Allocation Instead of Holding Cash - October 20th, 2023

Canada's annual inflation unchanged at 1.7% in May, core measures slightly ease

June 24, 2025

Canada's annual inflation rate in May was unchanged from the previous month at 1.7% as a drop in gasoline costs continued to keep the overall index stable while prices of shelter, food and transportation also cooled, data showed on Tuesday. There are concerns that a raft of tariffs imposed by Trump on steel, aluminum and automobiles exported to the U.S. from Canada and subsequent counter-measures from Canada would increase prices across the board....

Read more here: https://www.reuters.com/world/americas/canadas-annual-inflation-unchanged-17-may-core-measures-slightly-ease-2025-06-24/?utm_source=chatgpt.com

Mark Carney's Housing Plan: Timeline and Implementation

May 1, 2025

With the Liberals winning a minority government, the focus will turn towards Prime Minister Mark Carney’s plan to fix Canada’s housing crisis. On the campaign trail, Carney proposed a range of measures he said would double the rate of housing construction and build 500,000 new homes a year. Housing experts and economists say some of the proposed measures are promising, but some key challenges remain. And some measures will take a lot longer to implement than others...

Read more here: https://globalnews.ca/news/11159482/mark-carney-housing-plan-timeline/

Emerging Trends in Canadian Real Estate 2025

March 26, 2025

Published by PwC Canada, this article delves into the mixed outlook for the real estate sector in 2025. It highlights the increasing differentiation in market performance across regions and asset classes, noting that while some areas face challenges due to higher financing costs and changing investor interests, opportunities arise in niche property types such as data centers and student housing...

Read more here: https://www.pwc.com/ca/en/industries/real-estate/emerging-trends-in-real-estate.html

How to add 60 per cent to your home’s value - without adding rooms

December 6, 2024

The interior designer Rukmini Patel reveals how she added £280,000 to a four-bedroom Edwardian home by being clever with layout and overhauling the decor...

Baby boomers and gen X are taking on more mortgage debt

November 4, 2024

Rising number of home owners are turning to reverse mortgages, and among those, more are doing so to help their children with a down payment...

Read more here: https://financialpost.com/wealth/baby-boomers-gen-x-taking-on-more-mortgage-debt

Sick of home-owner stress, retirees can invest windfall from sale

October 14, 2024

Retirement brings for many the need to simplify. And a trend in paring down has even hit close to home within my own family. In retirement it’s natural to want to remove the stress that comes with owning a single-family home...

Read more here: https://financialpost.com/investing/how-retirees-invest-windfall-home-sale

FP Answers: What investments other than GICs protect buying power?

October 11, 2024

Bonds have earned their place as a sensible diversifier of returns over the long term. Q: I’m a retiree who has more than half her investments in guaranteed investment certificates (GICs). The higher rates have given me good returns of up to 5.5 per cent annually and I have used the extra money to supplement my modest income. But my GICs come due in January and I can see the writing on the wall. Their returns will dramatically drop as interest rates continue their downward descent...

Read more here: https://financialpost.com/investing/what-investments-other-than-gics-protect-buying-power

From small to extraordinary: The effect of compounding in investing

October 10, 2024

Compounding is one of the most elementary and popular investing strategies available to all levels of investors, from the most sophisticated pension funds to college students opening their first investment account. However, taking advantage of the benefits that compounding yields takes a considerable amount of both patience and conviction...

Read more here: https://financialpost.com/investing/from-small-to-extraordinary-the-effect-of-compounding-in-investing

2/23/2024 Fundamental Review

February 23rd, 2024

Happy Friday! Let’s dive into it!

Real Estate

TD predicts that house price inflation in Canada is set to resume:

Here is Toronto Star with an article also predicting house price inflation is set to resume:

According to CBC, rents rise 10% year-over-year in Canada in January 2024; recent data such as this is making it very difficult for Bank of Canada to start thinking about cutting rates:

Politics & Government

The Federal Government’s fiscal situation is at a crisis point. We simply cannot afford to continue spending the way we are without dire financial consequences:

When you hear politicians talk about “Climate Crisis”, do you ever wonder if it really is a crisis? Graph below should clarify it: Climate-related deaths are at an all-time low and have been declining rapidly in the past two decades.

Despite the federal government being $2T in debt and rapidly growing with annual deficits reaching $50B, The Prime Minister believes the government can afford to pay for more social services:

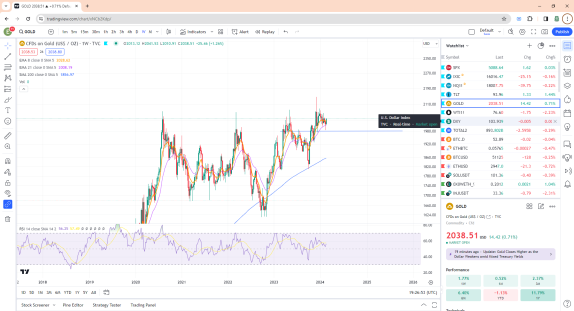

Gold & Commodities

Gold prices are still hovering close to all-time high ($2146.79) set in November of 2023. The price has held above the important support level of $1980 for nearly three months. It is probable that we see Gold make another push to break through the all-time highs set in November of last year;

Oil has been trading above the important pivot level of $67 since the middle of last year, and has been slowly rising towards $80 since December 2023. It remains to be seen how the price would react once it reaches $80, but a flip of that level could see prices quickly rising to the next resistance point of $90 which would have significant implications for inflation projections for the rest of the year;

Equities

S&P500 reached another nominal all-time high in February (it is still below inflation-adjusted high set in 2021). NVIDIA’s blockbuster quarterly results helped reverse a downtrend that had started in mid-February. It is difficult to predict which way the Equities will hear to in near-term, but as long as the AI mania (exemplified by NVIDIA) is in full swing, it seems illogical to be a bear;

Treasuries & Currencies

The USD bounced off its 200-day moving average this week. It remains to be seen if this reverses the downward trend started in mid-February. If it breaks below its 200-day moving average again, we can see a rapid decline to the lows set in December of 2023;

Bitcoin & Crypto

BTC prices have been holding above $50,000 since February 14th, and price is not far off from the all-time high of $69,000 set in November 2021. With less than 2 months remaining to the next Bitcoin halving, the bulls have a strong case to bet on continued upward movement for the remainder of 2024;

The rest of the crypto world is currently being led by ETH’s rapid price rise to $3,000 on rumors that an ETH ETF can get approved by May 2024.

What to do if your mortgage application is denied

February 14th, 2024

If you're turned down for a mortgage, it doesn't have to end your dreams of homeownership. Here's what to do next.

Read in CNBC: https://apple.news/AycsSh9A2Q4-MdsRi8KwMPg

1/26/2024 Fundamental Review

January 25th, 2024

Real Estate

According to the Bank of Canada, the rise in Canadian rents is perfectly correlated with population growth. It is hoped that the recent changes to the foreign student visa program announced by the Federal Government will be implemented promptly to alleviate the pressure on Canadians who are struggling with skyrocketing rent increases.

Canadian home sales reached their lowest level in 15 years. Surely, the high interest rates were the main cause of this downturn.

Mortgage interest and rent remain the two largest contributors to persistent inflation in Canada:

As if high mortgage payments weren’t burdensome enough for Canadian homeowners, they are now facing a 10% increase in property taxes. This situation highlights how out-of-touch politicians are negatively impacting the daily lives of ordinary Canadians.

Politics & Government

Shocking statistic of the day: Government spending in Canada accounts for 64% of GDP, a level comparable to that of the Soviet era’s extensive government involvement in the economy. If this trend does not reverse soon, the lives of Canadians may mirror those experienced by citizens in the late-stage Soviet Union.

We doubled the national debt, significantly expanded the money supply, yet ended up with a lower per-capita income in 2024 compared to 2015. This fact is worth remembering the next time a politician advocates for massive social program spending to aid the middle class. Such approaches often turn out to be illusory, resulting in poorer outcomes for those already struggling financially.

In 2024, Canadians are anticipating higher prices for all essential items:

Gold & Commodities

Over the past 10 days, gold prices have shown a downward trend. On January 22, 2024, gold prices eased due to reduced expectations of a U.S. interest rate cut at the end of March, with a surge in equity markets further dampening interest in safe-haven bullion like gold. The spot gold price was down 0.5% at $2,020.09 per ounce, and U.S. gold futures settled 0.3% lower at $2022.2. This decline in gold prices was influenced by several factors including technical selling, a rally in stock markets, and better U.S. economic data, which suggests that the Federal Reserve may delay lowering interest rates.

In addition, the bearish short-term forecast for gold prices (XAU/USD) was driven by recent statements from Federal Reserve officials indicating the need for more inflation data before considering rate cuts. The likelihood of a March rate cut has decreased significantly following positive U.S. consumer sentiment and robust labor market and retail sales data. As a result, the short-term outlook for gold prices leans towards a bearish sentiment, primarily influenced by the evolving landscape of Federal Reserve rate cut expectations and the broader expectation of a stronger dollar in the face of delayed rate cuts.

Oil prices have shown a general increase. As of January 25, 2024, the price of Brent crude oil was $81.65 per barrel, marking a 3.2% increase compared to its price a week earlier at $79.12 per barrel. Similarly, the price of WTI crude oil was $76.50 per barrel, up 3.73% from the previous week’s price of $73.75 per barrel.

A significant factor contributing to this rise was the reported inventory draw of 9.2 million barrels for the week to January 19, as reported by the Energy Information Administration. This drawdown in inventory was substantially larger compared to the 2.5 million barrels drawn in the previous week, indicating a tightening supply which often leads to higher prices.

These trends reflect the dynamic nature of the oil market, influenced by various factors including geopolitical developments, global economic conditions, and changes in supply and demand. It’s essential for those interested in the oil market to continuously monitor these variables, as they can have a significant impact on oil prices

Equities

S&P 500 has reached a nominal all-time high; it is still about 14% lower than its inflation-adjusted all-time high. Regardless, one must not be surprised by this given the out-of-control money supply expansion by central banks have been engaging in since 2008, and especially, since 2020.

Treasuries & Currencies

The yield on the 10-year U.S. Treasury note, a key benchmark for interest rates, experienced a decrease. On January 25, 2024, the yield stood at 4.13%, a drop of 1.11% from the previous day. This recent change is part of a larger trend over the past year, where there has been a significant increase in yield, indicating a rise of 19.23% year-over-year.

The movements in Treasury yields are closely watched as they reflect investor sentiment and expectations about economic growth, inflation, and Federal Reserve policy actions. The recent decline in the 10-year yield could suggest a variety of market perceptions, including expectations of easing inflation, shifts in economic growth forecasts, or anticipations of Federal Reserve policy decisions.

In the meantime, US Federal debt is on an unstoppable rise:

One might suspect that the current trajectory of debt accumulation might eventually result in significant devaluation of the US dollar, reminiscent of the hyperinflation experienced in Weimar Germany.

Bitcoin & Crypto

The recent approval of Bitcoin ETFs in the United States appears to have been a ‘sell the news’ event, with Bitcoin’s price declining by 20% over the past two weeks. However, our long-term perspective remains optimistic. Despite this short-term fluctuation, there is still a strong belief in the potential for Bitcoin to reach a price of $100,000 within the next 18 months.

Cryptocurrencies other than BTC – or the so-called Altcoins – have been on the same trajectory as Bitcoin in the past 2 weeks. Market declines have been a consistent feature in the cryptocurrency world from its early days. As for my investment strategy, I plan to HODL until the close of 2025. Following that, I intend to liquidate my positions and then re-invest at the end of 2026. This is not financial advice. It is one man’s risky perspective on the wildest of all assets: Cryptocurrencies.

12/19/2023 Fundamental Review

December 19th, 2023

Mass immigration, war, real estate shortage, stock market melt-up, and Crypto bull market.

Happy Tuesday! Let’s dive into it:

Real Estate

Canada’s population is growing at a record pace, and it’s putting massive upward prices on real estate costs:

How housing costs are driving inflation in Canada:

Canadian real estate costs are leading to homeless people dying in tents. To call this a crisis is a bit of an understatement.

At some point in the near future we can expect “Upzoning” to occur in Canada’s most densely populated areas. “Upzoning” in the residential sector refers to a change in zoning laws that increases the density of housing allowed in a particular area. Check out the effect this had on New Zealand’s housing costs:

Mortgage rates have fallen precipitously in the last two months in the US:

Politics & Government

Canada to ban sales of non-electric cars by 2035; Our opinion is that this policy will fail and will be reversed by the next government. Canada does not have the infrastructure to support such a transition.

Latest Federal polling shows Conservatives with almost a 100% chance of winning a majority:

Equity, Diversity, and Inclusion hits the medical profession:

“A new model of CanMEDS would seek to center values as anti-oppression, anti-racism, and social justice, rather than medical expertise.”

Half of all Americans make less than $41k:

How the “Tax the rich” narrative makes no sense:

Gold & Commodities

Yemen’s Houthis have declared their intention to attack all shipping in the Red Sea unless Israel ends its war with Hamas. Nearly 8.8 million barrels of Oil per day passes through the Red Sea. As a result, Price of Oil has bounced almost 7% from last week’s lows to $74 per barrel. The US army is leading an international task force to ensure transit safety through the Red Sea.

Gold prices are still hovering around all-time highs. here is a good analysis on what to expect for 2024:

Equities

Equities are ending the year smashing through two-year (non-inflation adjusted) highs:

This broad year-end rally seems to be driven off hopes of rate cuts in 2024:

A good article on implosion of Electric Car demand:

Treasuries & Currencies

The US dollar index continues it’s downtrend as traders price in the expected rate cuts in 2024:

US Treasuries have surged more than 20% since the end of October as yields fall. We believe they will continue to outperform equities in the near-term:

Bitcoin & Crypto

2024 will be the year of Crypto ETF’s:

Senator Elizabeth Warren is on a one-woman crusade to spoil the crypto party; safe to say she has not invested in any dog coins in anticipation of the 2024 bull market.

Capital Direct's Impactful Partnership with Cause We Care: A Season of Giving

December 8, 2023

In the spirit of the holiday season, Capital Direct proudly stands as a beacon of generosity and community support. As a Diamond Level Corporate Champion of the Cause We Care Holiday Care Package Campaign, the company has once again demonstrated its unwavering commitment to making a positive impact in our community.

The much-anticipated event took place on December 4th at the iconic BC Place Stadium, bringing together dedicated individuals and organizations determined to spread joy and support to those who need it most. Capital Direct took center stage by committing to match care package sales up to an impressive $35,000. This commitment, aimed at doubling the impact of donations, played a pivotal role in supporting a total of 400 care packages destined for single mother-led families across the Lower Mainland.

The incredible outcome of the Cause We Care Holiday Care Package Campaign was made possible through the generosity of Capital Direct and its dedication to making a difference. The matching donation initiative propelled the campaign to exceed its initial goal, ultimately funding a total of 1200 care packages.

Behind the scenes, the Capital Direct volunteers worked tirelessly to ensure the efficient packing and delivery of these care packages. Their efforts did not go unnoticed, and Cause We Care extends its heartfelt appreciation for the invaluable contribution to the campaign's success.

What makes these care packages so impactful? They include backpacks filled with warm clothing, $100 grocery gift cards, small gifts, and nutritious food items. These thoughtful bundles aim to bring comfort and joy to vulnerable families, making the holiday season a little brighter for those facing challenging circumstances.

Capital Direct's long-standing support of Cause We Care shines as a testament to their commitment to community well-being. This partnership has not only provided tangible support to single mothers in need but has also fostered a sense of unity and compassion within the community.

As we approach the holiday season, we extend our warmest wishes to the team at Capital Direct. May your celebrations be filled with joy, surrounded by friends and family. We look forward to continuing this impactful collaboration in the New Year, striving to create positive change in the lives of those who need it most.

In closing, we express our deepest gratitude to Capital Direct for their enduring support of Cause We Care. Together, we have made a meaningful difference in the lives of single mothers, embodying the true spirit of the season. To learn more about this campaign and how to get involved visit www.causewecare.org

Happy holidays to all, and here's to a New Year filled with continued generosity and community impact!

11/23/2023 Fundamental Review

November 23rd, 2023

Federal Government housing plans, temporary ceasefire in Israel, stunning election upset in the Netherlands, Open AI melodrama, and $200,000 pet rock NFT’s;

Happy Thursday! Let’s dive into it:

Real Estate

The Federal Government is planning on building more homes, faster. Colour us shocked when we look back in five years and see less homes were built, and slower:

TD Bank is forecasting a steeper drop in home prices amid a sudden surge of supply in some real estate markets. We see this as temporary; shortage of housing in Canada combined with large immigration numbers ensure that Real Estate prices in Canada will remain elevated despite short-term corrections:

US home affordability hits another low; but it is still significantly better than in Canada:

Politics & Government

A new report by the Federal Government estimates that by 2028, Canada will spend $60 Billion annually in interest expense on federal debt; this is unsustainable.

A couple tragically died at Canada-U.S. border yesterday. Early reports suggested that it might have been a terrorist attack, but it turned out to be a car crash.

The Federal Government estimates that deficit this year will hit $40 Billion. Unsustainable.

A temporary ceasefire has been reached between Hamas and Israel that includes the release of some hostages in exchange for Palestinian prisoners held in Israel. While it is good news that some humanitarian aid will reach ordinary people of Gaza, do not expect a permanent solution to this conflict unless Hamas is destroyed:

Seems like many ordinary Palestinians also recognize this fact:

Following the shocking victory of Javier Milei in Argentina last week, the Dutch voters last night delivered an even bigger shock by handing a stunning victory for Geert Wilders in Dutch election.

Globalization, open borders, multi-culturalism, and many other staples of post-Cold War Western politics are coming to an end at an astonishing rate:

Gold & Commodities

With gold news near all-time-highs, what can we expect next?

Climate change fanatics advocating for slashing oil & gas production to save the “Climate”:

Equities

The week was dominated by the firing, hiring by Microsoft, then rehiring at Open AI of the face of AI technology, Sam Altman:

According to some reports, what precipitated the dramatic showdown at Open AI was a technological breakthrough (Q*) that prompted the board to halt it by sacking Salm Altman.

An excellent thread detailing the whirlwind Open AI drama of the past week:

Treasuries & Currencies

The central banks seem determined to crash the economy to cool inflation. Time will tell if they are right; but none of this will matter unless governments endeavor to return to balanced budgets:

Bitcoin & Crypto

The most powerful man in Crypto, Changpeng “CZ” Zhao, plead guilty to money laundering charges from the US government. CZ will step down as the CEO of Binance – the world’s largest crypto exchange – and Binance will pay a hefty $4.1 Billion fine to settle with the US government.

It is important to see the Binance downfall in the context of the pending Bitcoin ETF approval. If major asset managers such as Blackrock are going to be in the Bitcoin business, they simply can’t have a competitor like CZ sitting in Dubai manipulating crypto asset prices without oversight.

And finally, pet-rock NFT’s are going for $200,000 again. remember 2021? It is all coming back with a vengeance and it might be a good idea to set some money aside to join the fun now instead of when Bitcoin hits $140,000.

11/19/2023 Fundamental Review

November 19, 2023 - Ash Ghanbari

War, equities melt-up, young folks discovering their love for Bin Laden, Carbon Tax, and so much more.

Happy Friday! Let’s dive into it:

Real Estate

CMHC predicts that Canada will be short up to 4 million housing units by 2030, resulting in an 89% surge in home prices. As an investor, keep investing in Real Estate; but perhaps it’s time to completely reimagine what our political class owe our country and start demanding seismic changes in our policies that are driving this disaster.

Canadian household debt levels reach another all-time high. Interest rates better come down or else…

Down in the US, housing starts jumped in October, continuing a trend of 10 straight rises in single-family housing construction. Perhaps demand for housing will continue this trend despite the high mortgage rates, or perhaps this trend will break sometime soon.

Politics & Government

Latest polling in Canada shows Conservatives with almost a 100% chance of forming a majority government in the next election. If these numbers don’t change in the next few months, the Liberal caucus will surely force the Prime Minister to step down:

This will surely work:

How many months until the Liberal caucus forces the Prime Minister to scrap this tax altogether?

Down in the US, the Federal Government is walking a tightrope in terms of supporting Israel’s war, and avoiding outright involvement. US Navy however seems to be involved regardless of stated Federal policy.

Never a dull moment in the Middle East. It has been burning for 5000 years, what’s another 2 weeks?

Why have we stopped caring about deficits? what will it take for us to wake up on this issue? Is a Weimar-style currency meltdown the only imaginable end-game that will wake us from this stupor?

I did not see this one coming; Bin Laden’s letter to America is finding a receptive audience among young Westerners. What can go wrong?

You can read the actual vile diatribe here:

https://web.archive.org/web/20210109060841/https://www.theguardian.com/world/2002/nov/24/theobserver

Gold & Commodities

Price of Gold is still holding the $1980 USD support level.

All-time high of ~$2070 USD is still within reach. It is important to note that appreciation in the price of Gold could be an early indicator for recessions. Gold has been a flight-to-safety trade for many generations in times of economic and geopolitical uncertainty:

Oil, on the other hand, has been in a downward price cycle for the past 3 weeks. Another early recession indicator? This Goldman Sachs article does a good job of explaining the recent plunge in price:

Equities

After a near 14% drawdown in Nasdaq from July highs, and a near 11% drawdown in S&P500, they have both had strong rallies from end of October and are near 2023 highs. It is possible that they break through those highs before end of the year. Just when you thought the bull market had turned into a bear market, the market made fools of both.

Treasuries & Currencies

Argentina’s Javier Milei was just elected the new President of Argentina. He is anti-Central Bank, anti-stage, pro-bitcoin, and pretty much anti everything else related to statism. It is fascinating to see how a libertarian would tackle Argentina’s chronic inflation and currency debasement; this could have a massive impact on future elections and monetary policy worldwide.

The US Dollar has been on a downward trend since end of October. It is now reaching its 200-day moving average which can act as major support. Not coincidentally, the fall in USD has corresponded with rallies in Nasdaq and S&P500.

Bitcoin & Crypto

The new Bitcoin bull market has commenced. The pending approval of the first spot Bitcoin ETF in the US is one of the major narratives pushing up the price of BTC and the entire crypto market.

In other major new, Blackrock has filed a prospectus for spot Ethereum ETF. Major players are now involved in crypto; it can never go away.

Cause We Care Holiday Care Package Campaign

November 15, 2023 - Shannon Newman-Bennett

Capital Direct is proud to be a Diamond Level Corporate Champion of the Cause We Care Holiday Care Package Campaign which will be held on December 4 th at BC Place Stadium. Capital Direct has committed to matching care package sales up to $35,000, doubling the impact of donations to support a total of 400 care packages to single mother-led families across the Lower Mainland.

Along with our support, Cause We Care Foundation will deliver care packages to 1200 single mother-led families this holiday season. For so many families the holidays are a financially challenging time. Capital Direct is pleased to help alleviate the burden on low-income families by partnering with Cause We Care to pack and deliver these essential care packages to neighbourhood houses, transition houses, schools and a variety of other front-line organizations.

The Holiday Care Packages include backpacks filled with warm clothing, $100 grocery gift cards, small gifts and nutritious food items that help to make the season much brighter for vulnerable families. We are pleased that our participation helps to improve the lives of thousands of single mothers and children in the Lower Mainland. To learn more about this campaign and how to get involved visit www.causewecare.org

10/30/2023 Fundamental Review

October 30, 2023 - Ash Ghanbari

Escalating war, treasuries sell-off, Bank of Japan capitulating on Yield-curve control, US tech indexes breaking below their 200-day moving averages, outright housing unaffordability, and….a looming recession?

Happy Monday! Let’s dive into it:

Real Estate

Combine low supply of housing, with currency debasement resulting from deficit spending, and suddenly Real Estate is the best investment to simply hold on to the value of your money. Percent of Investor ownership of new Canadian condos:

Housing supply is an issue, yet builders are sitting on massive amounts of inventory because not enough people can afford them, because the interest rates are too high, because inflation is too high, because our Federal Government has spent like drunken sailors for 8 years, and now no one knows how to actually get out of this 8th circle of hell:

The only people happy about the whole thing? These folks:

Politics & Government

Debate surrounding Carbon Tax in Canada is reaching a boiling point, as Scott Moe, The Premier of Saskatchewan threatens to stop collecting it all together unless Prime Minister Trudeau extends the Atlantic Canada exemptions to Saskatchewan as well;

Yes, add the Carbon Tax debacle to the seemingly endless parade of incompetence that can potentially bring down the Liberal Government:

It is a sign of our times that the obvious truth gets drowned out by endless academic jargon that sound too sophisticated to possibly be untrue. “Carbon Tax makes life more expensive” is somehow a controversial thing to admit:

Speaking of a more expensive life and unaffordability, google searches for “Give Car Back” reaches all-time high:

Down in the US, the Federal government has added over $600 billion in debt in the past month alone…and how do they respond? By sending more money overseas.

Add finally, 25% decline in purchasing power in 3 years as a result of reckless money printing:

Theme of the day: spend the money we don’t have, print it out of thin air, and burden the population with taxes we don’t need and inflation to boot.

Gold & Commodities

Price of Gold broke through the $1980 USD/ounce and traded as high as $2006 USD.

All-time high of ~$2070 USD is now within reach. It is important to note that appreciation in the price of Gold could be an early indicator for recessions.

Oil, on the other hand, is flirting with a break below $82 USD a barrel, and revisiting the 200-day moving average. Another early recession indicator?

Equities

Last week, both S&P500 and Nasdaq broke below their 200-day moving averages. Ask old-school traders what that means; not great.

Today however, we have had a bit of a melt-up. This is to be expected; the market makes fools of both bulls and bears until no one makes any money trading.

According to Yahoo Finance, “A more than 2% decline across all three major indexes last week brought losses since Aug. 1 to 10% for the S&P 500, 11.5% for the Nasdaq (^IXIC), and 9% for the Dow Jones Industrial Average (^DJI).”

Looking forward to this week, FOMC meeting is scheduled for this Wednesday where the Federal Reserve is expected to hold the rates steady but could potentially cause volatility for the equity markets as the meeting notes always cause traders to adjust expectations into the future, regardless of the immediate rate decision.

Furthermore, Apple’s earnings release are scheduled for this Thursday. Tech investors are jittery from last week’s earnings released by Alphabet and Meta, and on Thursday, Apple’s results can calm the markets or….provide even more jitters.

Treasuries & Currencies

Biggest news of the day came courtesy of Bank of Japan:

A great explanation of what that might mean for the markets:

Last week, US Treasuries reached levels not seen since the 2007/2008 financial crisis:

Will the Federal Reserve print more money to buy bonds to shore up their value? Can they even do that without risking even more inflation? if not, how will the treasuries recover?

That is the $100 Trillion question. And one that I suspect no one will have an answer to (I am only half-serious. The answer can be found in a barrel of cash being exchanged for a loaf of bread in 1923 Weimar Germany).

Bitcoin & Crypto

We might be witnessing the start of a new Bitcoin bull market. Amongst all the ups and downs and turmoil of global financial markets, one thing seems to take place with regularity: A BTC bull market every 4 years.

Bitcoin is now up more than a 100% in 2023. Last week, it broke through $32,000, an important resistance level that had been unbroken through the year. On the surface, the price action seems to be driven by the pending approval of the first spot Bitcoin ETF in the US; but as I mentioned, Bitcoin seems to have its own cycles that repeat every 4 years regardless of any new developments.

Conflating Bitcoin with Crypto in general is incorrect; Crypto contains a massive amount of fraud via centralized coins that get pumped and dumped with regularity. This is not to say that all coins outside bitcoin are useless; That definitely is not true, but I would wager that as high as 99% of crypto coins are either useless or fraudulent.

And speaking of fraud, the biggest fraudster in the history of Crypto is on trial at the moment:

JPMorgan Advocates for a 60/40 Portfolio Allocation Instead of Holding Cash

October 20, 2023

JPMorgan Asset Management contends that the traditional 60/40 portfolio remains a robust and more compelling investment option than holding cash in the upcoming decade. The strategy, allocating 60% to equities and 40% to Treasuries, is projected to outperform cash by an annualized 4.1 percentage points and inflation by 4.5 percentage points over the next 10 years, despite current money-market funds offering upwards of five percent returns...

Read more here: https://epaper.nationalpost.com/article/281891597949187

Navigating Tech Challenges: Identifying AI Winners and Assessing the Value Based on Consumer Benefits

October 20, 2023

Markets exhibit a certain teenage temperament, marked by volatility and a penchant for novelty. In the current equity landscape, while the majority of stock prices have experienced declines, a select few, notably dominant technology companies on the global index, have seen impressive gains. Notably, Apple Inc., constituting 5.2 percent of the global index and witnessing a 43 percent surge this year, boasts a PE ratio of 29, a modest dividend yield of 0.6 percent, and an anticipated 8.8 percent earnings increase next year...

Read more here: https://epaper.nationalpost.com/article/281835763374339